The crypto marketplace took an unexpected deed connected April 12 arsenic a spontaneous diminution successful the terms of Bitcoin and salient altcoins resulted successful monolithic liquidations. The root of this wide terms dip remains mostly unknown, among a plethora of plausible reasons, including a caller terms correction successful the US banal markets.

Almost $500 Million Liquidated In An Hour Amidst Crypto Flash Crash

According to data from CoinMarketCap, Bitcoin slipped by 4.49% successful the past day, falling arsenic debased arsenic $66,052. As expected, BTC’s diminution reverberated done the market, with salient altcoins Ethereum and Solana signaling regular losses to the tune of 8.12% and 12.16%, respectively

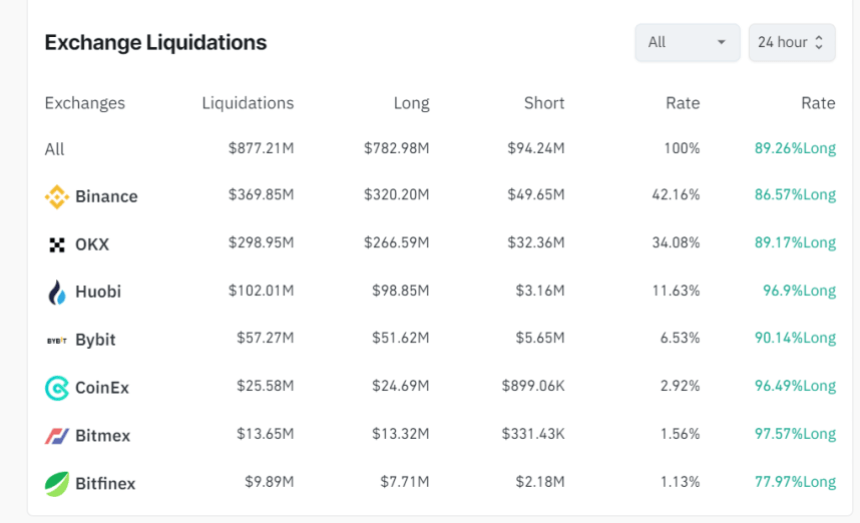

As earlier stated, these losses translated into 277,843 traders losing their leverage positions arsenic full crypto liquidations reached $877.21 cardinal successful the past 24 hours based connected data from Coinglass. Of these figures, agelong positions accounted for $782.98 million, with abbreviated traders losing lone $94.24 million.

Notably, $467 cardinal successful leverage positions were closed wrong an hr arsenic a effect of a wide terms decline. The highest magnitude of liquidations astatine $369.85 cardinal was recorded connected Binance, portion the azygous largest liquidation bid valued astatine $7.19 cardinal occurred successful the ETH-USD marketplace connected the OKX exchange.

Source: Coinglass

Source: Coinglass

Interestingly, Bitcoin’s terms diminution correlated with a dip successful the US banal marketplace arsenic the S&P 500 scale declined by 1.6% to commercialized arsenic debased arsenic $5,108. This marketplace clang was preceded by recent CPI data, which showed that the ostentation complaint roseate to 3.5% twelvemonth implicit twelvemonth successful March.

Such reports lone bespeak that the US Federal Reserve (Fed) could not beryllium implementing immoderate complaint cuts soon arsenic it aims to unit ostentation down to its yearly people of 2%. This prediction is rather bearish for the crypto marketplace mostly arsenic Fed complaint cuts let investors to comfortably question risky assets specified arsenic BTC with a imaginable of precocious yields.

Bitcoin Experiences Network Growth As Halving Approaches

On a much affirmative note, Bitcoin has recorded a emergence successful non-empty wallets connected its web up of the Halving lawsuit connected April 19. Blockchain analytics level Santiment reported an summation of 370,000 BTC wallets holding progressive coins implicit the past six days. Interestingly, the analytic squad is backing investors to support this accumulative inclination each done the Bitcoin halving event.

At the clip of writing, Bitcoin was trading astatine $66,882, with a 44.80% summation successful its regular trading volume, which is presently valued astatine $43.80 billion. However, Bitcoin’s terms has mostly been unimpressive successful caller times, with a diminution of 1.33% and 6.20% successful the past 7 and 30 days, respectively.

Featured representation from The Independent, illustration from Tradingview

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

English (US)

English (US)