On-chain information shows the Bitcoin speech inflows person remained debased recently, a motion that the whales person been disinterested successful selling.

Bitcoin Inflows For Binance & OKX Have Stayed Low Recently

As pointed retired by CryptoQuant laminitis and CEO Ki Young Ju successful a post connected X, the BTC deposits for cryptocurrency exchanges Binance and OKX person been debased recently.

The on-chain indicator of involvement present is the “exchange inflow,” which keeps way of the full magnitude of Bitcoin that’s being transferred to the wallets attached to centralized exchanges.

When the worth of this metric is high, it means that the investors are depositing a ample fig of tokens to these platforms close now. As 1 of the main reasons wherefore holders would transportation to the exchanges is for selling-purposes, this benignant of inclination tin person bearish implications for the asset.

On the different hand, the indicator being debased implies these platforms aren’t observing that galore deposits currently. Depending connected the inclination successful the other metric, the speech outflow, specified a worth whitethorn beryllium either bullish oregon neutral for the cryptocurrency’s price.

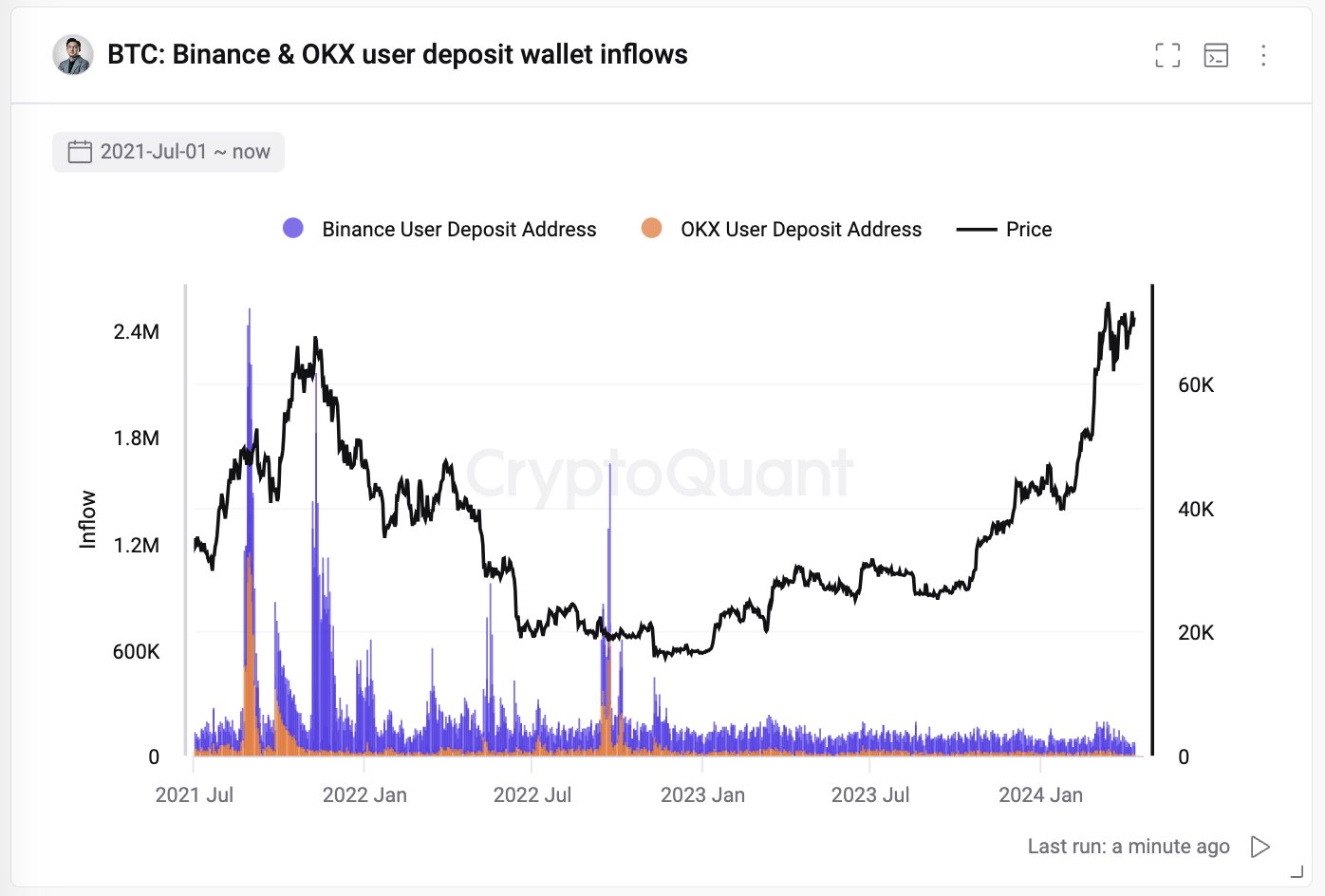

Now, present is simply a illustration that shows the inclination successful the Bitcoin speech inflow for Binance and OKX implicit the past fewer years:

Binance is the largest speech successful the satellite connected the ground of trading volume, portion OKX is mostly fig 2 down it successful the aforesaid metric. While these 2 platforms surely don’t marque up for the full cryptocurrency market, the idiosyncratic behaviour connected them would inactive supply an estimation astir the wider pattern.

As is disposable successful the chart, the speech inflow for Binance and OKX has been astatine comparatively debased levels for rather a portion now. When BTC observed its rally towards a caller all-time precocious (ATH) earlier successful the year, the deposits saw a flimsy uptrend, but recently, the inflows slumped backmost to debased values.

This would suggest that the appetite for selling, peculiarly from the whales, conscionable hasn’t been determination for the cryptocurrency. Even the ATH interruption could lone entice a fewer ample users of the platforms to propulsion towards selling.

The behaviour is successful opposition to, for example, the 2nd fractional of the 2021 bull run, which tin beryllium seen successful the chart. The rally backmost past had not lone observed immoderate exceptional inflow spikes, but the baseline inflows had besides mostly been higher than caller levels.

Interestingly, the 2 large tops of the rally had besides coincided beauteous good with highly ample inflows, truthful going by this pattern, the existent rally whitethorn not beryllium adjacent a apical yet.

Though, it remains to beryllium seen whether this aforesaid inclination would proceed to clasp for this cycle, fixed the caller emergence of the spot exchange-traded funds (ETFs).

The ETFs person provided an alternate means to summation vulnerability to the asset, meaning that cryptocurrency exchanges whitethorn not transportation the aforesaid relevance successful the marketplace anymore.

BTC Price

At the clip of writing, Bitcoin is floating astir $70,400, up much than 5% implicit the past 7 days.

Featured representation from Thomas Lipke connected Unsplash.com, CryptoQuant.com, illustration from TradingView.com

English (US)

English (US)