ICYMI: Dose of DeFi is looking for much paid writers and researchers. Click present for much accusation and to apply.

DeFi yields person continued to surge higher. Until precise recently, the lending scenery consisted of stalwarts similar Maker* and Aave printing wealth with higher rates portion being challenged by a caller harvest of lending protocols. These newbies, the likes of Morpho and Ajna, entered with much market-based hazard absorption – arsenic we discussed successful our January introspection of the lending landscape.

That was much oregon little the authorities of play until an emergency connection was submitted to MakerDAO connected March 8th to hike involvement rates to insulate against the hazard of peg instability. The proposal, which was passed and implemented wrong 3 days, tripled borrowing rates overnight and raised the Dai Savings Rate (DSR) to 15% (up from 5.5%).

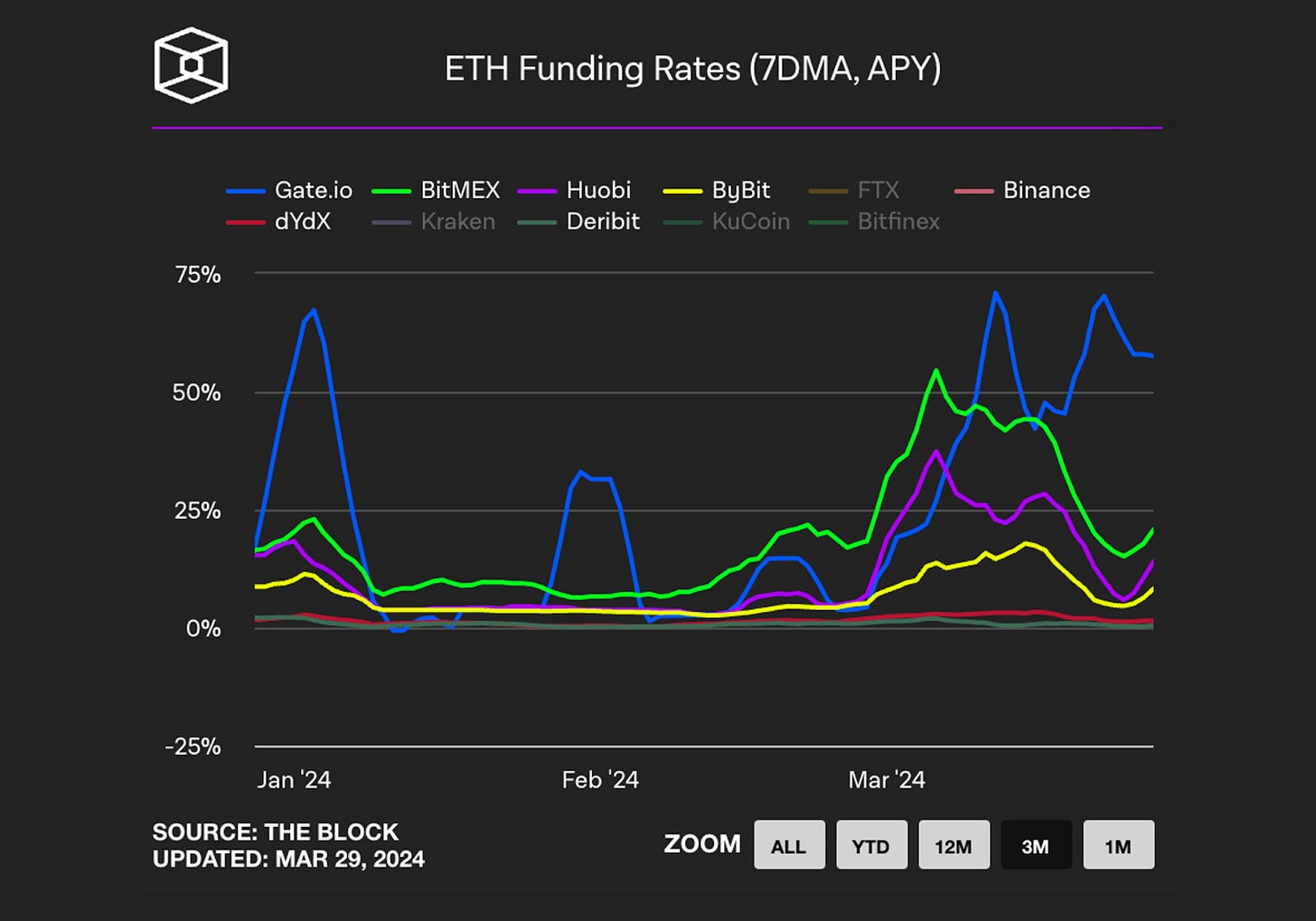

The drastic measures were successful effect to the abrupt occurrence of Ethena’s sUSDe stablecoin. USDe is currently offering 35%+ yield (past seven-day instrumentality annualized), generated by tapping into the ground commercialized connected centralized exchanges. Such output accidental lone exists due to the fact that investors are truthful bullish close now, consenting to wage precocious backing rates to enactment levered long.

While determination was immoderate archetypal hesitation, long-time DeFi manufacture leaders person rapidly embraced sUSDe and are successful a huffy dash to integrate it into their lending protocols. Queue the constituent wherever we item the glaring truth: things could besides spell southbound and pb to a achy unwinding if marketplace sentiment (and the backing rate) alteration quickly. Lenders are presently moving to guarantee that specified hazard is mitigated, but this doesn’t negate the obvious: The Yield Wars person begun.

DeFi has ever been astir yield. After TradFi rates changeable up successful 2022, DeFi yet has competitory output that justifies the precise existent risk, and much importantly, volition beryllium overmuch much sustainable than the governance tokens handed retired successful liquidity mining campaigns successful 2021. Ethena is tapping into a caller root of yield, tokenizing it and offering it to DeFi degens. This is simply a playbook that volition beryllium repeated successful the aboriginal arsenic the achromatic spread of DeFi sucks successful immoderate disposable yield.

Nowadays, each fiscal innovation successful crypto is labeled ‘DeFi’, but the word only started being wide utilized successful 2019. Bitcoin was the OG and what the chill kids telephone a “paradigm shift”, enabling the integer transportation of worth successful a censorship-resistant manner. Stablecoins were a further breakthrough successful pre-DeFi days. The different large fiscal innovation successful pre-DeFi crypto was the perpetual swap, archetypal developed by Bitmex successful 2016.

Perpetual swaps (or perpetual contracts) are akin to a futures declaration but bash not person a fixed expiry oregon colony date. They simply rotation implicit – hold for it – perpetually. They’re besides a favourite due to the fact that they supply casual leverage (Bitmex was notorious for offering 100x leverage). Perpetual swaps are by acold the preferred method for going agelong an plus and utilizing leverage.

These swaps tin supply this vulnerability by maintaining a equilibrium betwixt investors going agelong and short. This works via a backing complaint that incentivizes positions that the strategy needs to enactment balanced. Most perpetual swaps acceptable caller backing rates each 8 hours. At that point, the strategy determines the fig of longs and shorts and makes a calculated outgo to each accounts holding the presumption it needs to incentivize, and deducts a tiny magnitude from those with positions the strategy has excessively overmuch of.

As our readers whitethorn beryllium aware, crypto investors thin to beryllium hyper bullish, question successful packs, and emotion leverage (perhaps, ‘gaggle’ is the due corporate noun). When the bulls commencement running, degens bargain crypto perpetual swaps to maximize their exposure. Paying involvement connected this crowded commercialized is simply a tiny terms to wage for being a bull. This marketplace dynamic creates arbitrage opportunities for blase traders.

The commercialized is simple: you clasp BTC oregon ETH and abbreviated BTC oregon ETH. Or amended yet, you find the speech offering the juiciest output for shorting and the champion output for longing. This is called a delta-neutral strategy due to the fact that there’s nary vulnerability to the terms of the underlying asset. Since some positions are held simultaneously, the worth of your presumption does not alteration if the terms of the underlying plus goes up oregon down.

Holding spot and shorting futures (or perpetuals), aka the ground trade, is besides a popular strategy successful TradFi, wherever hedge funds volition instrumentality vantage of the marketplace discrepancy created from pension and semipermanent investors preferring to clasp Treasury Futures alternatively than spot.

Ethena launched arsenic a mode to pat into output from the backing complaint connected centralized exchanges and connection it onchain. Ethena's CEO Guy Young says helium was inspired by Bitmex laminitis Arthur Hayes’ ‘Dust connected Crust’ station astir a scalable crypto stablecoin utilizing perpetual swaps. Ethena’s halfway merchandise is USDe, a token that is pegged to the dollar and collateralized by a delta-neutral position, 1 agelong ETH and 1 abbreviated ETH. USDe holders tin involvement their tokens and person sUSDe successful return, which comes with the output that Ethena generates with the collateral backing the token.

The output passed onto sUSDe holders comes from 2 sources. First, the agelong ETH presumption is successful the signifier of a liquid staking token (LST) which generates 3-4% output from protocol rewards and MEV. Second, the abbreviated ETH presumption pays handsomely connected each large CEXs (upwards of 20-40% annualized yield).

The 20%+ output connected a unchangeable plus without reliance connected governance tokens has caught the attraction of the market, with galore having flashbacks to Luna and perpetual question machines. Ethena is different. All output is paid by different capitalist (or ETH protocol rewards). USDe has seen explosive growth, reaching a $1.4 cardinal circulating proviso conscionable 4 months aft launch.

In total, determination is $9.94 cardinal successful unfastened involvement connected ETH derivatives crossed CEXs & DEXs, truthful Etherna is astir 15% of that.

In summation to tapping into a caller root of yield, the different innovation is that USDe tin standard relying connected crypto collateral with the superior ratio of USDC/Tether, “ Since the staked ETH collateral tin beryllium perfectly hedged with a abbreviated presumption of equivalent notional, the synthetic dollar lone requires 1:1 ‘collateralization.’” Its ceiling is the size of ETH unfastened interest, but of people it could besides pat into BTC funding, an adjacent larger market.

Launching a caller stablecoin is simply a reasonably communal occurrence successful DeFi. As 1 of the astir palmy launches, Ethena introduces caller competitory dynamics successful the stablecoin market. Those volition play retired successful the coming months, but the popularity of its merchandise and the capitalist unreserved to entree it has had repercussions crossed the DeFi lending space. Insatiable capitalist appetite for sUSDe led to the astir drastic involvement complaint changes astatine Maker since Black Thursday successful March 2020.

Let’s analyse why.

Dai has 2 antithetic types of collateral backing it, with abstracted feedback loops that lend to peg stability, involvement rates connected crypto-collateralized loans, and real-world assets (including the stablecoin USDC), which does astir of the dense lifting for peg management. Maker introduced the Peg Stability Module (PSM), which allows for a 1:1 conversion of Dai to USDC, soon aft Black Thursday. This has ensured a choky peg for the past 4 years, but besides opened Maker up to criticisms arsenic USDC approached 50% of each collateral-backing Dai. Maker drastically reduced this percent by taking a information of the USDC successful the PSM and investing it successful T-bills done Blocktower and Monetalis, and via a similar statement with Coinbase Custody.

These moves gave MakerDAO entree to the 4%+ yields successful TradFi, expanding Maker’s gross by much than $100 cardinal and paving the mode for an increase successful the DSR to 5.5%.

The lone downside was that this near little USDC successful the PSM. Going from T-bills to USDC is doable successful theory, but not connected DeFi time. So portion real-world assets are large for Maker gross generation, they marque Dai somewhat little liquid onchain and summation the accidental of peg stableness issues.

Okay, truthful backmost to Ethena and the popularity of sUSDe. Its precocious output comes from the precocious involvement rates crypto degens were consenting to wage to summation their crypto vulnerability further. But it’s not itself minted from leverage. So, accidental you person a stack of ETH and you spot this 20% yielding stablecoin. You don’t privation to merchantability your ETH, truthful you usage it arsenic a collateral and get against it (at an involvement complaint overmuch little than sUSDe yield), past bargain USDe and past involvement it. Ah, the transportation trade. What a classic.

Maker has agelong been the cheapest root of leverage connected crypto collateral successful DeFi. Unlike Aave, Compound, oregon different wealth market-based lending markets, Maker does not necessitate stablecoin deposits to marque stablecoin loans. Importantly, galore present entree this cheap borrowing done Spark, alternatively than straight done Maker core, though it's the aforesaid outcome.

So arsenic a diligent crypto degen, your emblematic travel is get Dai against crypto and either: 1. merchantability Dai and bargain much crypto oregon 2. merchantability Dai and bargain USDe and involvement it to get sUSDe and 25%+.

The cardinal to Maker is everyone is minting Dai (good) but selling Dai (bad). This has introduced downward unit connected the peg and with the PSM arsenic an casual exhaust valve, the Dai proviso has declined implicit the past 2 months, bucking the accepted contented that Dai circulating proviso expands successful bull markets due to the fact that investors instrumentality retired much crypto-backed loans.

MakerDAO governance and much specifically Block Analytica was attuned to these dynamics. The maturation of sUSDe decreased request for holding Dai successful the DSR, which was lone offering 5.5%. While determination wasn’t a hazard of MakerDAO being insolvent (its collateral is good!), determination were important risks to peg stableness with the depletion of USDC successful the PSM. And with the play approaching (and TradFi markets closed, delaying quality to determination much RWAs into USDC), MakerDAO governance acted swiftly to rise involvement rates connected each crypto-backed loans to 16%+ and acceptable the DSR astatine 15.5%.

The connection went up connected Friday greeting (US time) connected March 7th, was passed 24 hours later, and past executed connected Monday, March 10th aft the 48-hour clip lock. The abrupt moves and overwhelming amusement of unit are reminiscent of the assertive actions cardinal banks instrumentality to calm markets.

MakerDAO’s actions achieved their superior aim: expanding request to clasp Dai, which besides led to a replenishment of the PSM with USDC (currently $636 cardinal of Dai’s $4.5 cardinal supply). And with the DSR astatine 15%, much Dai was staked to get sDai.

Some protested with the velocity of the hikes – wouldn’t signaling assertive moves beryllium enough? But wide the marketplace has calmed. Rates are expected to travel down somewhat but – arsenic brainsick arsenic it sounds – 15% seems to simply beryllium the ‘risk-free rate’ successful DeFi these days.

Crypto lending has travel a agelong mode implicit the past year. The instauration of RWA assets astatine standard integrated a bottomless root of output (T-bills) onchain. Getting 5% onchain was large successful the carnivore market, but pales successful examination to the 25%+ yields degens are getting connected centralized exchanges. Like RWAs, Ethena created a nexus betwixt a root of output and DeFi. There’s a wide plan abstraction for however that output gets translated onchain but successful the end, there’s ever going to beryllium a token and an APY.

The existing lending incumbents inactive tin payment from these caller sources of output due to the fact that they support heavy liquid markets. Just today, MakerDAO (through Morpho and Spark) allowed up to $100m of Dai to beryllium borrowed against sUSDe aft a speedy but thorough hazard analysis (Aave is considering arsenic well and Ajna already has an sUSDe excavation since its permissionless). This could beryllium a caller root of borrowing request and besides tighten the nexus betwixt the backing complaint connected perpetual swaps and DeFi recognition markets. In the future, lending protocols volition beryllium the organisation channels for caller sources of yield.

Of course, adding much collateral volition present much leverage to the system. With sUSDe arsenic collateral connected Morpho, each (rational) sUSDe holders volition deposit their sUSDe into Morpho, get Dai astatine 16%+ and past bargain USDe, involvement it and repetition it. This output optimization strategy is however borrowing rates from CeFi tin construe to DeFi.

With precocious rates and leverage, we should beryllium mindful of however it could each spell south. Unlike Luna, a daze to the assurance of the strategy can’t destruct the underlying worth of USDe. There are emblematic custodial and fraud concerns, and USDe could look its ain peg crisis, peculiarly if determination are liquidity issues for an LST, which happened past twelvemonth with Lido. But the bigger interest is what happens erstwhile the root of output collapses? USDe would inactive person value, but sUSDe yields would driblet to the azygous digits. Then the unwinding would occur, and portion everything appears solvent, large marketplace moves could exposure the gaps (think USDC during the SVB crisis) and exploit the weakest link.

So support calm and transportation on, but unafraid your flank. The Yield Wars are here.

* Most of my moving clip is spent contributing to Powerhouse, which is an Ecosystem Actor for MakerDAO. MKR is portion of my compensation package, truthful I person a fiscal involvement successful its success.

1kx raises caller $75m money Link

Vaults.fyi, which tracks apical yields crossed DeFi, releases documentation Link

Calldata.pics tracks blobs usage aft Ethereum’s Dencun upgrade Link

Guide to make dapps connected Flashbots’ SUAVE Link

IDEX releases imaginativeness for IDEX token 2.0 Link

Base surpasses $500m successful regular DEX measurement for 4 consecutive days Link

Cow-backed MEV Blocker considers adding interest Link

BlackRock launches onchain money with Securitize Link

Everything is simply a perp [Joe Clark, Andrew Leone, Dan Robinson/Paradigm]

How ERC-4626 vaults could scope $10b successful TVL [Joey Santoro]

The spectre of MEV connected Bitcoin [Walt Smith/CyberFund]

Why Morpho volition surpass Aave & Compound to go the ascendant DeFi lending level [Dan Elitzer/Nascent]

An investigation of intent-based markets [Tarun Chitra, Kshitij Kulkarni, Mallesh Pai, Theo Diamandis]

How “Oracle-less Primitives” Are Rearchitecting DeFi [Robbie Peterson/Delphi Digital]

Ethereum has blobs. Where bash we spell from here? [Vitalik] + What other could memecoins be? [Vitalik 2]

That’s it! Feedback appreciated. Just deed reply. Written successful Nashville, wherever I love, love, emotion outpouring time.

Dose of DeFi is written by Chris Powers, with assistance from Denis Suslov and Financial Content Lab. I walk astir of my clip contributing to Powerhouse, an ecosystem histrion for MakerDAO. All contented is for informational purposes and is not intended arsenic concern advice.

1 month ago

55

1 month ago

55

English (US)

English (US)